Of course the merger was a success. Neither company could have lost that much money on its own.

-Steve Case, Former Chairman of the Board

AOL/Time Warner

Competitive markets create an environment wherein companies strive for revenue growth. When organic (internal) growth is hard to come by, inorganic growth becomes a target. Inorganic is a category that includes merger and acquisition (M&A) activity as a primary strategy.

While business exigencies demonstrate the “need” for change, often the hard facts found in classic due diligence processes have far less to do with ultimate success than the cultural fit of a transaction between parties. Consequently, organizations that understand their core values are much more likely to reach the kind of growth and success that nearly all businesses seek [Gallangher 2003].

Successful M&A has been known to grow markets, build on complementary strengths, and eliminate inefficiency. But what ultimately matters in an acquisition is what happens in the hearts and minds of the people who remain with the new organization and what culture these formerly distinct entities choose to build while moving forward [Gallangher].

The Mercer Consulting Group, in studying M&A activity, finds that, among unsuccessful ones that many of the failures are caused by not conducting the same kind of “due diligence” on the culture, structure, and processes of an acquisition target as they do on the financial balance sheet [Gallangher].

Traditional due diligence typically analyzes the following:

– Historical performance,

– Ownership and organizational structure,

– Management team,

– Products and services,

– Assets and liabilities,

– Information systems and technology, and

– Organizational culture [Bouchard, Pellet 2002].

J. Robert Carleton, management consultant and senior partner of the Vector Group, says, “Unfortunately, little or no time is generally spent analyzing the nature, demeanor, and beliefs of the people who will be involved in carrying out the business plan”. He believes that standard due diligence does not address some of the key questions that must be asked to accurately assess organizational readiness for a major change, such as a merger or acquisition. Even when some of the “right” questions are asked, Carleton argues, they are often limited to brief interviews with key executives, who likely have differing views from the rest of the employee group. The people in the trenches, the ones doing much of the actual work are not even involved. He finds it interesting that “in financial and legal due diligence no such ‘act of faith’ is acceptable” in terms of the investigative procedure [Bouchard, Pellet].

“Cultural due diligence” is a phrase that more strategists are using to assess what stumbling blocks may hinder successful integration of entities and their operations. Key factors to be considered include:

– leadership and management practices, styles, and relationships,

– governing principles,

– formal procedures,

– informal practices,

– employee satisfaction,

– customer satisfaction,

– key business drivers,

– organizational characteristics,

– perceptions and expectations, and

– how the work gets done in your organization

[Bouchard, Pellet; see also Carleton, Lineberry 2004].

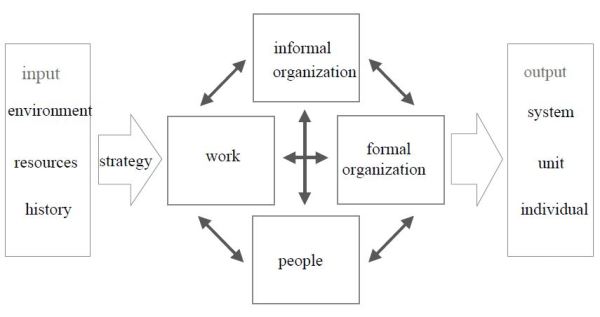

When HP and Compaq decided to combine forces, they used schematics like the one below to help them discuss the salient issues–

After looking through these issues and discussing each company’s culture, the merger team put together a chart like the one below to begin developing tactics to plan for a smooth post-closing integration.

As you look at this chart, think about key M&A transactions in your industry or local community. Of the ones that did not pan out as planned, do you think they would have stood a better chance had they systematically worked through these type issues during due diligence?

Cultural due diligence is vital to successful M&A processes. If earnest consideration were given to culture as it is to financial and other factors, inorganic growth and increased market share would be a realized outcome far more often!