While one may not be able to improve IQ, the ability to improve one’s Emotional Quotient has been shown effective in enhancing management decision-making. EQ Mentoring is most successful when directed management team members who support an organization’s executives.

“Emotional intelligence isn’t a luxury tool you can dispense with in tough times. It’s a basic tool that, deployed with finesse, is the key to professional success.”

~Dan Goleman in The Harvard Business Review

What is Emotional Intelligence (EQ)?

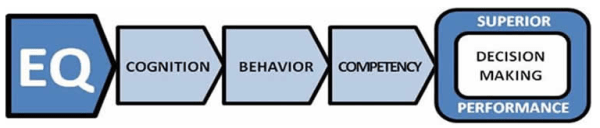

Effective and timely decision-making is at the heart of good performance. To improve performance, we need to understand how to make better decisions. At the most basic level, our ability to make good decisions and, in turn, perform well is captured by our competencies. Competencies are the things we know how to do and what we are good at are capabilities. Most performance management processes are built on the concept that competencies are the direct antecedent or predecessor to good decision making and high performance. What determines our competencies?

Preceding our competencies are our behaviors. Behaviors include our day-to-day activities that determine where we focus our time and where we focus our energies. Cognition precedes behavior. Slightly oversimplifying this concept, cognition refers to one’s intellectual capacities, thoughts, knowledge, and memories. This is the rational part of our brain. What finally precedes cognition in this physiological sequence to high performance is one’s EQ—a body of personal characteristics and social abilities that are closely tied to success in both our professional and personal lives.

How is EQ Improved?

In order to establish a baseline, an EQ Assessment is taken at the inception of the competency improvement process by each team member individually. The mentoring process is explained to the group and some recurring group meetings are held (minimum of once/month) to reinforce concepts in a team environment. Primarily, however, the mentoring occurs individually and the scheduling of weekly meetings with each team member (half hour ea.) creates an environment for concepts to “grow legs” and become implemented.

The mentoring is administered by a professional certified in the process and competent to interpret the assessment results into a personal development program. The five competencies (self-awareness, self-regulation, motivation, empathy and social skills) that constitute one’s EQ scores are evaluated and a plan created to improve the mentee’s lowest area(s) first.

During the weekly sessions, hypothetical scenarios are discussed between mentor and mentee to identify thought processes, offer alternatives, and learn better decision-making styles. After six to eight weeks, the hypothetical gives way to actual work examples and on-the-job learning occurs. Generally, it is at this point that executives can see early signs of improved management skills.

As the mentee becomes more enlightened, additional tools and assessments are introduced to keep the free flow of information positive, eye-opening, and stimulating. Generally, a follow-on assessment is administered at the six month point and a joint decision is made as to how to proceed.

NOTE: For EQ improvement to become part of the culture, it is generally advisable that the owner/CEO/etc also submit to the process and go through their own mentoring. After such, there is opportunity to learn new methods of interaction that reinforce principles and better habits learned.

Management of a business is tough work. Having a mentor can make a big difference. Some of the things a mentor can offer include:

Management of a business is tough work. Having a mentor can make a big difference. Some of the things a mentor can offer include: