“Focus Not on Protecting What You Have, Instead Obsess on the Next Big Thing.”

While this type of headline may not serve us very well in interpersonal relationships, it has become the watchword in business. Those who rest on yesterday’s accomplishments eventually find themselves with less and less current successes. Since we live in a day and time when ideas are ubiquitous, information plentiful, and communications vastly enhanced, it is incumbent upon every enterprise to remain on the hunt for “wow.”

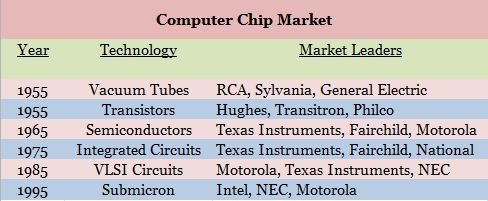

Jeremy Gutsche of Trendhunter wrote in Exploiting Chaos that the disk drive, computer chip, and word processing markets were all ones that saw enormous changes and the market leaders were often outflanked. Read on:

Borrowing from Clay Christensen’s work in The Innovator’s Dilemma , Gutsche described the progression in the disk drive industry towards constantly smaller drives. Along the way, observe the shift in power:

Observe how great organizations present in 1980 gave way to more nimble upstart startups over 15 years. Though the only apparent change was size of the drive, it was enough innovation occurring at a rapid enough rate to trip up the “big boys.” Perhaps, one may suggest, disk drives had become commoditized as more PCs were manufactured? This theory seems to hold true in computer chips, then, as well. To note:

Observe that this market experienced a slower rate of change (40 years of upheaval vs. 15), but the net result was the same: market leaders gave up leadership to disruptive alternatives. The fact that semiconductors require very extensive research and development efforts, whose project funding ranged into the billions of dollars, made this a significant economic microtrend. Gutsche points out that RCA was once twice the size of IBM, so the thought process that monetary barriers to entry would protect industry leaders was disproved time and again.

Word processing was once known as typewriting and the market leader was Smith Corona. Smith Corona was extraordinarily innovative, boasting over 100 patents spread over decades. Yet, the company who also invented the first word processor did not continue to reinvent itself in the computing age and lost its market leadership role. It is suggested that the historical accomplishments became blinders to the urgency for continuous improvement. Notice, they understood the concept of reinvention, but underestimated the urgency factor.

Lest you think that Smith Corona had been mismanaged over the course of the 20th century, pay attention to the fact that their annual revenues in 1989 were $500 million! What happened? Let’s look at some of the competition and what strategic decisions they made…Remington recognized the opportunity of computers and made the leap in 1950, only to be too early to that niche, lose money, and the computing division sold off in 1981. Perhaps Smith Corona saw the foibles of a competitor and vowed not to make the same mistake?

Commodore, on the other hand, was a different kind of competitor. Their model 128 was introduced in 1985 with two external floppy drives. The Smith Corona PWP 40 was preferred by buyers by a wide margin for word processing applications. Yet, someone inside the company saw an opportunity to partner with Acer on a computer joint venture. Unfortunately, the plug was pulled before the strategy could run its course. Smith Corona declared bankruptcy in 1995; Acer became the fourth-largest PC company in the world!

Scott Anthony, writing for Harvard Business Review in an article entitled “Disruption is a Moving Target” observed a clear pattern:

- Disruptors enter a market incumbents don’t care about.

- Entrants grow as incumbents flee.

- The incumbent hits a ceiling.

What should be learned from this insight? Larger companies should not ignore small opportunities simply because they start out small. Smaller companies should plan their strategy and tactics around “nibbling at the edges” of an incumbent’s market share.