Take a look at the programs available to start-up businesses and you will certainly find that many offerings are based on a business plan. Governmental and educational agencies in particular are often enamored with curricula that present a template for plans that is easily administered and a breeze to teach. The emphasis is usually on the various business disciplines that can be found in a larger business, but applied to a small business. Instructors generally come from corporate or academic careers and are most comfortable with this approach. Yet, most entrepreneurs, when “equipped” with the suggested program, are unable to reach the five years in business anniversary–a full 50%+ fail according to the U.S. Department of Labor’s Bureau of Labor Statistics.

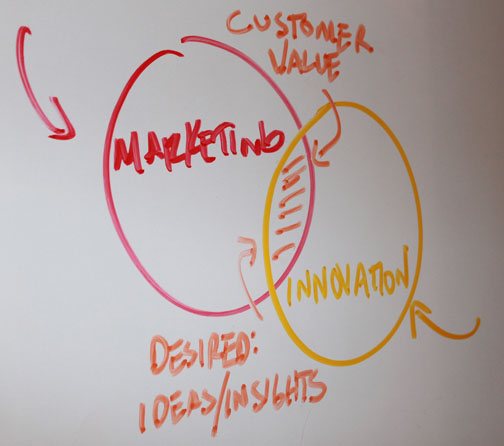

Observe the chart below, used by EntreDot to illustrate how an idea should become a commercially viable business:

Business planning is an outgrowth of three prior steps: ideation, conceptualization, and creation. What occurs in each of those steps that better prepares the entrepreneur to actually write a business plan? “Ideation is the process for structuring an idea into a well explained business idea that has enough information for the entrepreneur to decide whether it has commercial potential and whether or not it should be pursued any further. Conceptualization is focused on developing an understanding of the market the entrepreneur intends to pursue, and gathering enough information about it to be able to decide if there is commercial value in the business idea. Creation provides the details of the products and services from the point of view of what capabilities the customer will have and how they will see quantifiable benefit. The focus is on what it provides the buyer and the description has to be from the customer’s point of view and what will be delivered to them.” (courtesy, EntreDot)

Every viable business needs to address the following five issues:

o What is the opportunity (premise)?

o What are you offering (solution)?

o Who will buy it (market)?

o Why will I win (Advantage)?

o How do I make money (Business)?

Ideation is the step in which the issues are raised–not Evaluation (Step 4, where business planning occurs). By wrestling with these questions early, the entrepreneur hones a business idea into an elevator pitch that can be “test marketed” to potential buyers. The key advantage to having a story to tell and people to whom it can be told is the opportunity to collect key data during Conceptualization. The feedback is incorporated into the Creation step. As a result of this improved process, entrepreneurs are able to refine the product offering and message to become a more powerful resonator with a specific target audience.

The other process, the more prevalent one described in the first paragraph, is faulty by comparison–and not just because it is being carried out by people who have next to no small business experience (launching their own enterprises.) By beginning with a business planning process, the typical entrepreneur is making a series of assumptions. The vast number of assumptions that have to be made to construct a business model from which a plan can be developed is likely to be the proverbial “house of cards.” Assumptions built upon assumptions that lead to projections about assumptions is a presumptuous risk, the outcome of which is likely to be business failure in one out of every two businesses started by the five year mark.

It is way better to eliminate as much of the guesswork as possible so that, when we arrive at Evaluation (Step 4, including the business plan), the planning is focused. The discipline of determining buyer needs–rather than simply looking at internal capabilities and developing products in an isolated manner–yields a recipe for improved business success as risk is eliminated through data verification.

Do your homework before business planning and your ideas will meet with greater implementation success!