Keeping a finger on the pulse of the company is essential; financial reports and management information provide vital signs of business performance. The accuracy and timeliness of financial and management information is, therefore, critical for maximizing profits.

Systems Management

The person managing your company’s management information systems is a key ally for the business owner. With responsibilities encompassing data collection, entry and analysis, this employee must have a solid grounding in accounting and information technology. In addition, the manager must be able to implement solutions to problems discovered during review and analysis of the information generated.

Reporting Systems

Three areas affect the way reports can be used to enhance company profitability:

- how information is entered and maintained

- how results are read, and

- how the reports are used to influence business decisions.

The daily tasks of information entry and data maintenance are the building blocks of any management information system. Since it does not accurately reflect the true operating and financial conditions of the business, incorrectly entered or antiquated information can lead a company to ruin if used to make important decisions. The systems manager should employ systems, then, that are relatively easy to use and allow for daily but controlled data entry; menu-driven systems are easiest to use. The system should be selected based on designed checks and balances of the data to prevent reliance on incorrect information. Review of information to catch any errors or omissions and make corrections is a best practice.

Be sure that management team members all know how to use the system. If only the systems manager can use the system, it is useless because one person begins to wield too much influence and indirect control over the company’s direction. Take care not to fall into a trap of the system driving the company rather than the other way around.

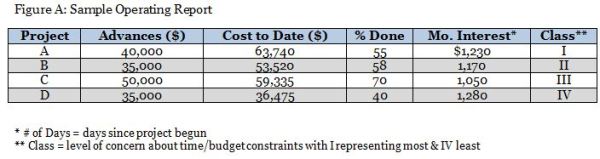

Reading reports requires more than a casual glance; a thorough study of a report’s essential indicators gives the owner and other key executives in-depth knowledge of operating performance. The figure below is an example of such a report:

An effective system must be able to generate this kind of information. For example, reading Figure A prepares an executive to question issues of timeliness in production scheduling, loan advances, and interest rates.

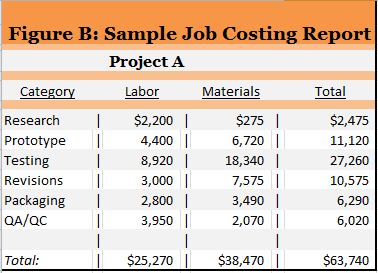

Figure B is a job costing report. The way in which the report is read and interpreted will affect every decision made–or not made–with regard to the job listed. Comparing this report with a similar report for a project either in progress or completed, the relationship between the materials and labor for specific designs can be determined. The goal of the report is to establish standards for purposes of comparison; current projects are compared to the standards to analyze their performance.

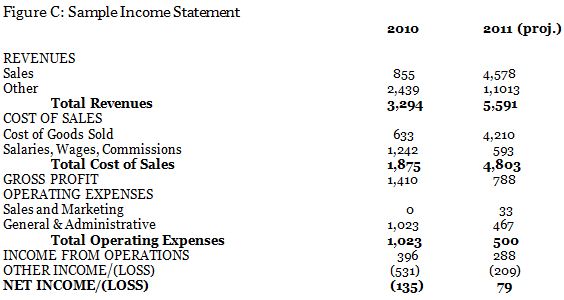

Figure C shows a sample income statement for a growing small business ($3-5 million in sales). The income statement reports prior activity and should therefore be used to modify future business operations to maximize profits. The statement needs to be even more detailed than the sample below to help determine how the profits or losses are being generated. One can be profitable and still not have cash. Cash flow projections, incorporating actual expenses, show the sources and uses of cash and are a good complement to the income statement and balance sheet.

The ability to read and understand reports and statements prepares the executive team member to use the information to influence business decisions. After reviewing Figure B, you should be equipped to establish workable production schedules. Subsequent production meetings should highlight areas to reduce costs and improve production deadlines.

Figure B should be discussed with all managers, who in turn implement the schedules and budgets with subs and vendors. The resulting scheduling and budgeting systems ensure timely, cost-efficient job completion. Managers also need to assist in keeping the information current.

In Figure C, data is presented comparing the current year to the prior year in order to analyze trends and ratios. Tracking composite numbers such as gross profit takes on meaning when it serves as a basis for comparison, rather than being viewed in isolation. Deviations from the norm should be discussed in management meetings. So, if sales and profits are lagging, the group should investigate any underlying causes and develop alternative production and sales methods–and implement them immediately.