60% of mergers, acquisitions, and joint ventures fail to perform up to expectations in their first year, often because of cultural incompatibilities between the two prospective partners. The losses in shareholder value are in the hundreds of millions of dollars in many of these star-crossed liaisons. Cultural Due Diligence is a technique for keeping both eyes wide open when approaching an attractive prospect, whether for a merger, joint venture, or offshore vendor.

-Wayne State University, Institute for Information Technology and Culture

When two companies agree to join forces in some type of agreement, cultural fit is usually the last factor considered-if at all! Instead, many numbers are crunched, recrunched, and analyzed ad nauseum. Market impact, anticipated back office savings, etc receive the lion’s share of the secondary consideration after financial statement items. “Culture” is perceived as too soft an issue to justify the time and attention of high-powered executives. Big mistake!

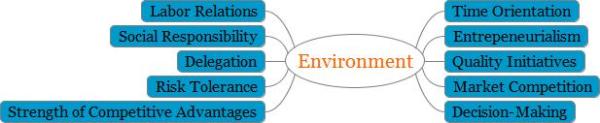

At the very minimum, the operating environment and organizational structure of each entity needs to be explored. When we are working with a client, we use the following two charts to help us ask solid questions about these two components of culture. From the answers received, we make value judgments and recommendations as to the degree of “fit” between organizations and what to do about it.

In considering the operating environment, we look at whether the company has a long-range or short-term approach to management. We ask questions to determine whether the organization is more entrepreneurial or bureaucratic. Quality initiatives are a good indicator of what aspects of performance are most important to management. The degree an strength of market competition for each party is important. How decisions are made is another leading indicator of what it may be like to work alongside the other team.

How management handles relationships with employees, (unions), and contractors is important to search out. Is giving back to the community and having respect for the environment a value of the other organization? Do meaningful tasks get delegated effectively, or are there barriers to professional development , shared responsibility, and growth through the contributions of many? Discovering how the other party perceives risk and builds strategy accordingly is a key conversation. When one’s competitive advantages are articulated, it is vital to verify how strong they are in the eyes of the buyers.

In addition to the operating environment, it is critical to understand the organizational structures that represent the philosophy of your intended. Do employees have direct access to top executives, or must they work through a layered management team? Understand whether the employees feel that they are protected to the point of not being allowed to make any mistakes. Examine whether generalist skills are valued versus everyone having a narrow scope. Look at the board of directors to see whether it is comprised of objective, strong leaders. Pay attention to the diversity of the employees and management team.

If the other company has a multi-office system, is it managed out of corporate, or are those in the field given autonomy? Notice whether task or relationships seem to carry more weight. Analyze the turnover rate among management and key positions. Is the human resources department deep enough to undertake complex issues like training and development, talent management, succession planning, coaching and the like, or compliance focused? Ask for examples of how technology is used to solve problems and enhance work flow.

The careful review of these “soft” factors can save you some headaches and hardships–do it! (We would love to help.)